Distributors across the cannabis industry are rapidly evolving to align with dynamic consumer preferences, demonstrating agility and innovation. As legalization spreads and consumers become more demanding, these middle‑men are transforming from simple logistics providers into strategic partners helping shape product lines and market trends.

Leveraging Real‑Time Feedback Loops

Prior to retail, distributors interact closely with dispensaries and brands, gathering market insights on product turnover, potency, formats, and even packaging preferences. This ongoing feedback enables cultivators and manufacturers to quickly tweak offerings—whether that means boosting high‑potency flower, premium terpene profiles, or wellness‑oriented seedlings. Distributors increasingly act as frontline market researchers, bridging consumer demand with production decisions.

Expanding Channels & Formats

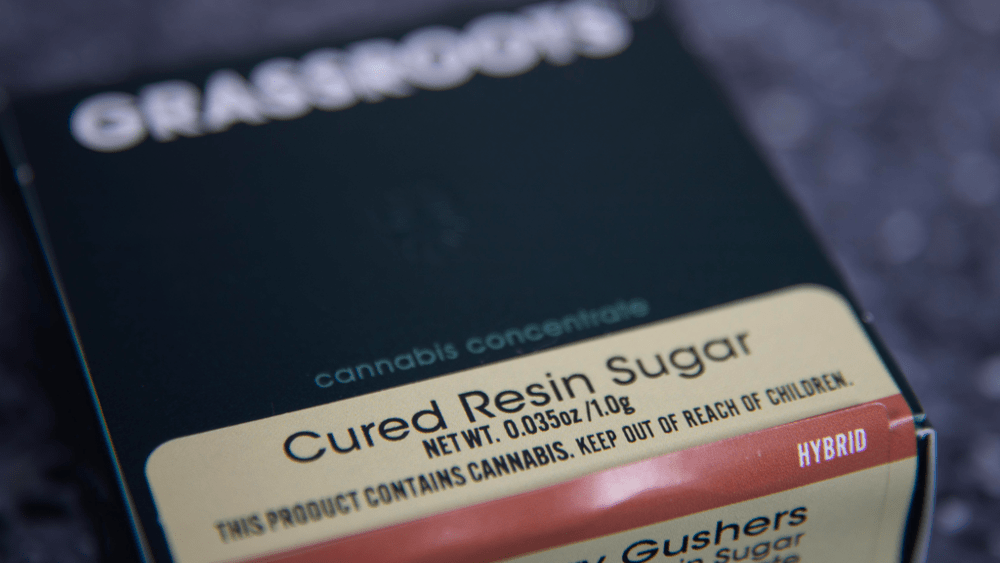

Channels like pre‑rolls, beverages, edibles, concentrates, and wellness‑focused products (CBG, CBN, low‑dose THC drinks) have seen rapid uptake. In 2024–25, pre‑rolls and ready‑ground flower rose fastest, reflecting consumer preference for convenience. Similarly, low‑dose THC drinks—mirroring seltzer diversification—are appealing to new and health‑oriented buyers. Distributors are thus onboarding producers that specialize in these trending formats, ensuring shelves stay relevant.

Catering to Wellness and Sustainability

Consumers now demand transparency and eco-consciousness. This manifests in preference for organic flower, regenerative agriculture, carbon‑neutral packaging, and minor cannabinoids targeting sleep or stress relief. Distributors adapt by sourcing from suppliers emphasizing organic practices and by promoting these credentials upstream. This alignment allows wellness brands to reach shelves effectively.

Tech‑Enabled Coordination & Compliance

To support this complexity, distributors are deploying software stacks—inventory platforms, embedded B2B menus, real‑time analytics—to enable matching supply with demand in regulated frameworks. Cold‑chain logistics, digital traceability, and POS integration allow them to deliver the precise products retailers need while sustaining compliance across jurisdictions.

Adapting to State Regulations

Regulatory fragmentation means states have distinct rules, taxes, and consumer bases. Distributors are tailoring their logistics accordingly—managing transport restrictions, varying tax regimes, excise structures, and compliance steps. In markets like New York, distributors face supply bottlenecks due to regulation capping indoor flower supply—so they must pivot to alternative products or state‑specific categories.

Becoming Strategic Growth Partners

More than order‑fillers, modern distributors act as consultants: advising retailers on package design, merchandising strategy, product lineup, and educating producers on what’s resonating at store‑level. With vertical integration on the rise, they also partner with craft brewers or beverage companies—like Tilray leveraging beer networks—to pioneer cannabis‑infused beverages tied to brand identities.

Insight:

Distribution is no longer just about moving product—it’s a strategic conduit that translates evolving consumer behavior into production, marketing, and supply decisions. Distributors that master data, tech, and regulatory navigation will serve as indispensable architects of tomorrow’s cannabis marketplace, while sluggish ones risk obsolescence amid a buyer‑driven revolution.