-

Wholesale Cannabis’s Big Opportunity: The Move to Schedule III

As momentum builds toward the rescheduling of cannabis from Schedule I to Schedule III, bulk distributors across the U.S. are beginning to reassess their potential…

Keeping You Informed

Posts & Latest News

-

Human + Machine: The Future of Bulk Cannabis Processing

Read More: Human + Machine: The Future of Bulk Cannabis ProcessingIn the rapidly evolving cannabis industry, AI and automation are making significant inroads—from cultivation to extraction, trimming, and…

-

Local Impact of Large‑Scale Marijuana Centers: Jobs, Taxes, and Community Balance

Read More: Local Impact of Large‑Scale Marijuana Centers: Jobs, Taxes, and Community BalanceLarge-scale marijuana distribution centers have emerged as significant economic engines in regions where cannabis has been legalized. From…

-

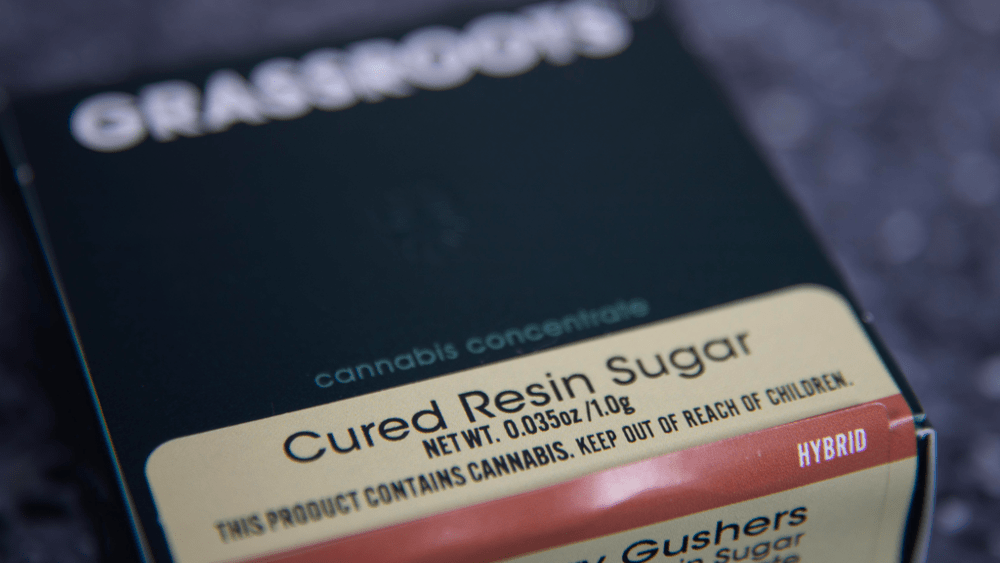

How Distributors Are Reinventing The Cannabis Supply Chain To Meet Consumer Tastes

Read More: How Distributors Are Reinventing The Cannabis Supply Chain To Meet Consumer TastesDistributors across the cannabis industry are rapidly evolving to align with dynamic consumer preferences, demonstrating agility and innovation.…